Strong demand from key end-uses: Demand for alloys remains high, driven by several large sectors: automotive (especially EVs/lightweight vehicles), construction & infrastructure, aerospace/defense, energy infrastructure (solar, power lines), packaging, etc.

Growth outlook long-term: According to recent forecasts, the global aluminum-alloy market is expected to grow from ~ USD 155.1 billion in 2025 to ~ USD 252.7 billion by 2035 — a ~5.0% annual growth rate.

Supply tightness & structural constraints: In 2025, supply–demand dynamics (tight supply, strained scrap availability, energy costs, regional policy/regulation shifts) have pushed prices up.

Sustainability / green-aluminum drivers: Environmental and regulatory trends are making recycled aluminum and lower-carbon “green aluminum” more attractive. That is helping drive investment and demand for alloyed/recycled aluminum variants.

Bottom line: structural demand + constrained supply + regulatory/green trends = ongoing support for aluminum-alloy prices and market value.

Price volatility and uncertainty: The price of aluminum (and alloys) has been volatile in 2024-2025. One big factor: recent tariff moves (e.g., in the U.S.) and trade policy uncertainty.

Mixed demand in some segments: Secondary aluminum (recycled, scrap-based) prices have seen soft patches — some downstream buyers remain cautious; for example some reports show demand softness in automotive and construction in certain regions.

Regional differences & energy / cost pressures: In regions with high energy costs (like Europe) or regulatory complications (scrap export restrictions, carbon border adjustment policies), supply constraints, price premiums, or supply-chain disruptions could challenge consistent growth.

Macro-economic & trade risks: Slower global growth prospects, trade tensions or tariffs, and shifting economic conditions (especially in major consuming or producing countries) raise downside risk.

In 2025, on a global basis, baseline aluminum-alloy market value is ~ USD 155.1 billion.

Prices: According to recent data, alloy/ aluminium prices began 2025 stronger than 2024, with upward swings tied to tariff moves and pre-tariff stockpiling. For a time, contract/offer prices reached about USD 2,540–2,580/tonne before stabilizing.

Growth forecast: Broad forecasts expect continued growth in aluminium demand + alloys through 2030 and beyond, supported by long-term structural drivers (autos/EVs, infrastructure, energy, etc.).

Producers & Alloy Makers — It’s generally a favorable environment: robust demand, high alloy/metal prices, favorable long-term outlook, and growing demand in EVs, infrastructure, and green-aluminum space.

Buyers / Downstream Users — Expect higher input costs, some volatility, and possibly tighter availability — but also a push toward recycled/green alloy materials, which might affect sourcing/mix strategies.

Investors & Suppliers of Scrap / Secondary Aluminum — A mixed picture: while primary-aluminum prices are high, secondary-aluminum pricing and demand has seen softness, especially where downstream demand is weak. Risk remains in cyclical demand dips and cost pressures.

Strategic / Long-term Planners — Given structural demand trends (lightweighting, EVs, renewable infrastructure, recycling), aluminum alloys remain a key material. But success depends on managing supply-chain, energy costs, geopolitics, and adopting sustainable production/ recycling practices.

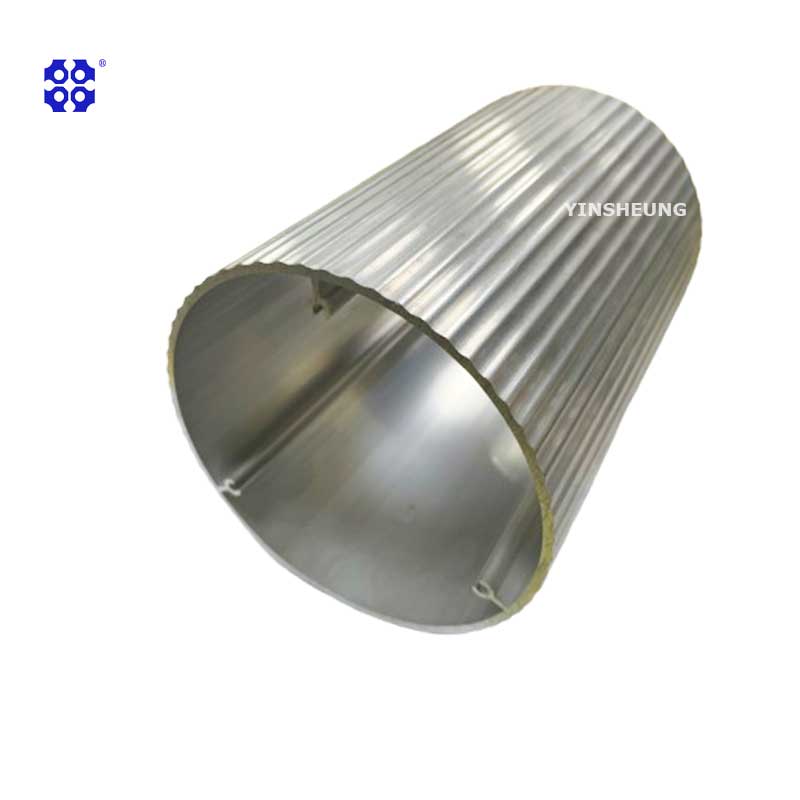

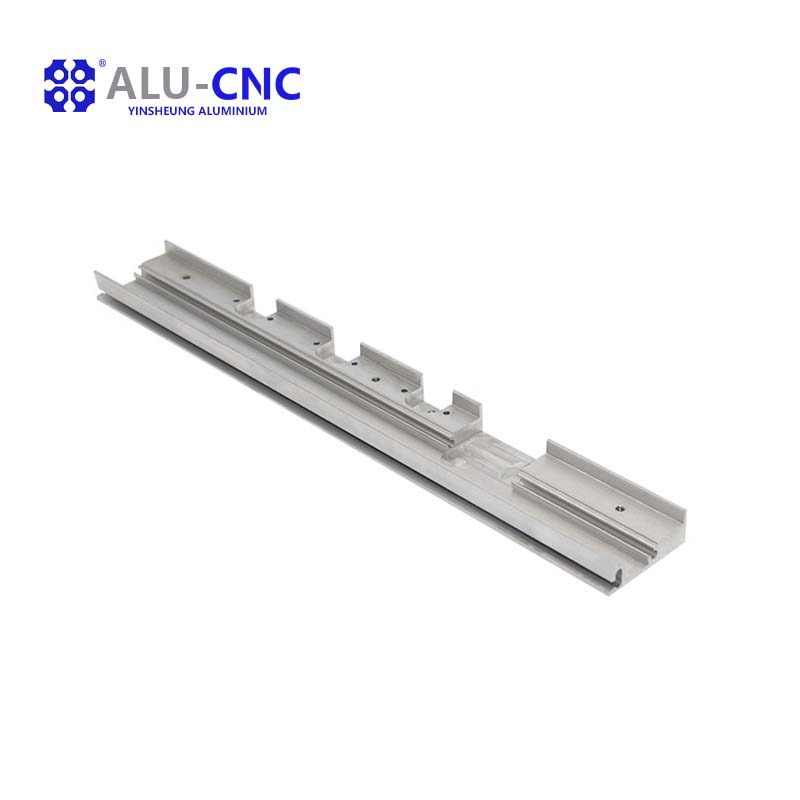

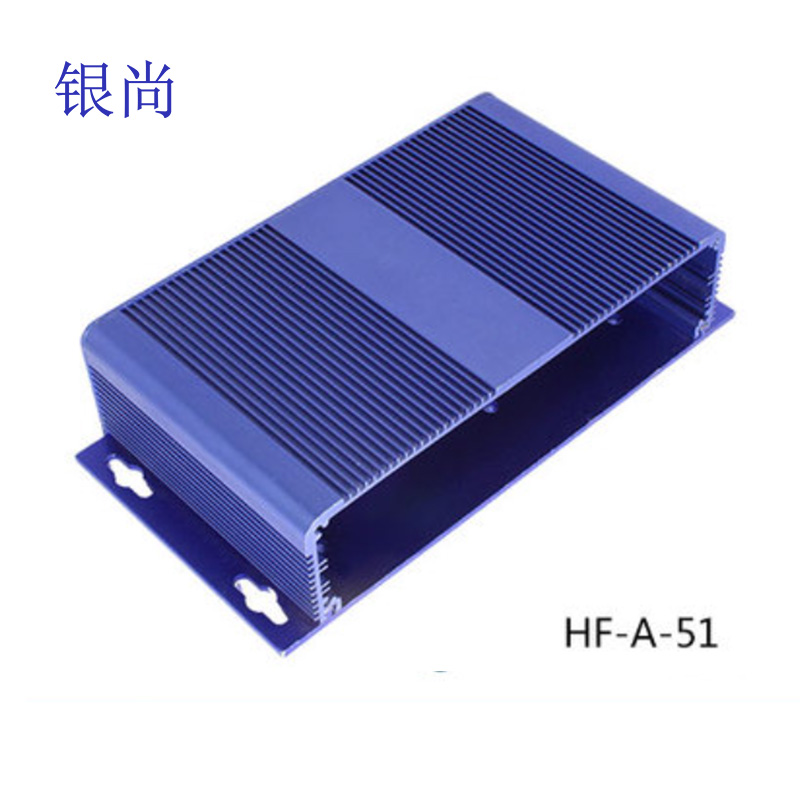

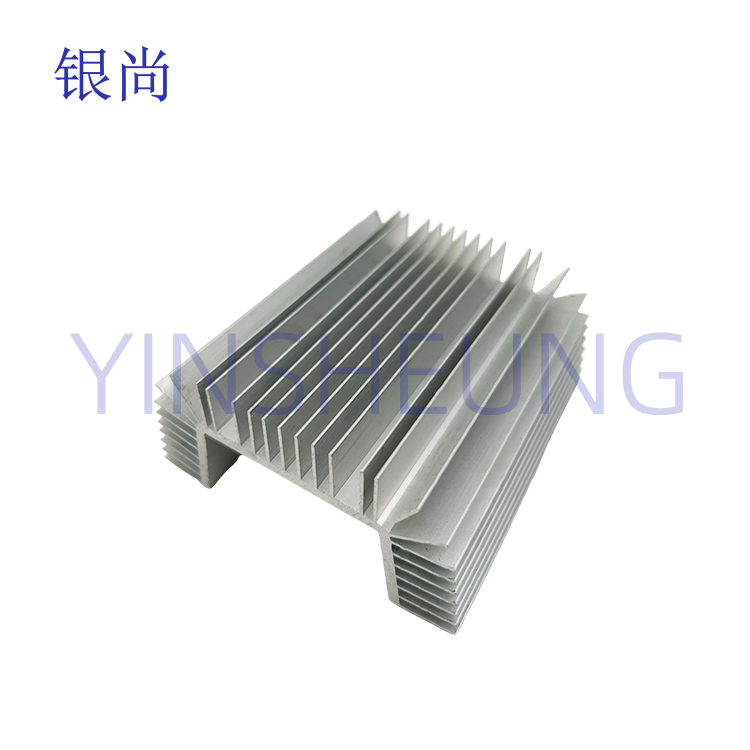

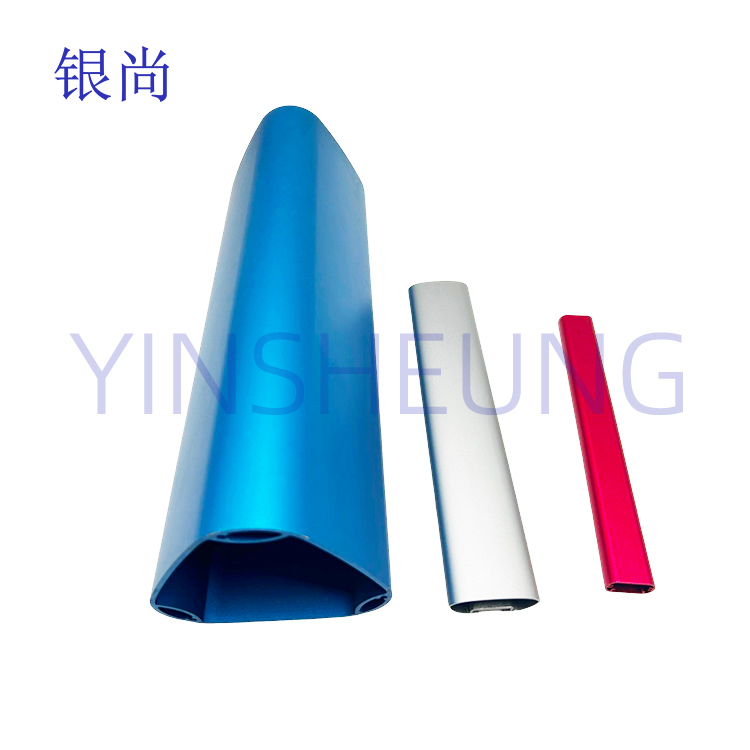

As global industries accelerate toward lightweight, high-efficiency, and sustainable solutions, the aluminum profile sector is stepping into what many experts call its Golden Decade. From 2025 to 2035, rapid advancements in new energy, high-end manufacturing, and green development will transform the landscape of this once traditional industry. For forward-thinking companies like Yinsheung, this wave presents not only growth opportunities, but also a chance to shape the future of industrial materials.

Guideline

Recently, Karlheinz Zuerl, CEO of German Technology and Engineering Company (GTEC), published a sharp commentary article, directly pointing out Europe's self-indulgence and over-packaging in "industrial digitalization". He pointed out mercilessly: "Europe is obsessed with the illusion of Industry 4.0, while Asia has already moved towards true independent manufacturing."

We have sorted out the key points in this article to help you understand the deep roots of this "manufacturing perception gap".

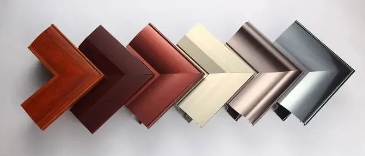

Environmentally friendly chemical polishing of aluminum profile